The Federal Reserve on Wednesday, March 22, 2023, raised the key short term rate by a quarter percentage point, expressing caution about the recent banking crisis and indicating that hikes are nearing an end.

25 Basis Point Rate Hike

The Fed’s latest move brings the federal funds rate to a range of 4.75% to 5%. It’s expected to further slow economic activity including reach estate market as it drives up rates for credit cards, adjustable-rate mortgages and other loans.

How Mortgage Rates Are Determined

Your mortgage’s interest rate is essentially the cost a lender charges you to borrow money to financed the purchase of a home. This rate is expressed as a percentage and can be fixed, meaning that it’s locked in and won’t change throughout the life of your loan. Or, it can be a variable rate, which means that it can (and likely will) change in response to larger changes in the market and economy.

The Federal Reserve does not set mortgage rates—they’re set by individual lenders. However, the Fed does set one crucial rate: the federal funds rate. This rate can have impacts that trickle down to sway rates on consumer lending products like credit card APRs, savings account APYs, auto loan rates, and even mortgage rates.

The federal funds rate is an interest rate that banks charge other banks when they lend one another money, usually overnight or for a few days. Certain regulations require banks to keep a certain percentage of their customers’ money on reserve, and banks will lend money back and forth to maintain the right level.

When inflation is running high, the Fed will increase rates to increase the cost of borrowing and slow down the economy. When it’s too low, they’ll lower rates to stimulate the economy and get things moving again.

Several factors influence mortgage rates. On a macro-level, mortgage rates tend to increase or decrease in response to the overall health of the economy, the inflation rate, the unemployment rate, and other key economic indicators. On a micro-level, rates will vary from lender to lender and your own financial stats. A mortgage is a loan, and your lender assumes a certain level of risk by loaning you that money depending on your income, credit score, employment situation, and debt.

What Does Rate Increase Mean for Mortgages?

Rates on 30-year fixed mortgages don’t move in tandem with the Fed’s benchmark rate, but instead generally track the yield on 10-year Treasury bonds, which are influenced by a variety of factors, including expectations around inflation, the Fed’s actions and how investors react to all of it.

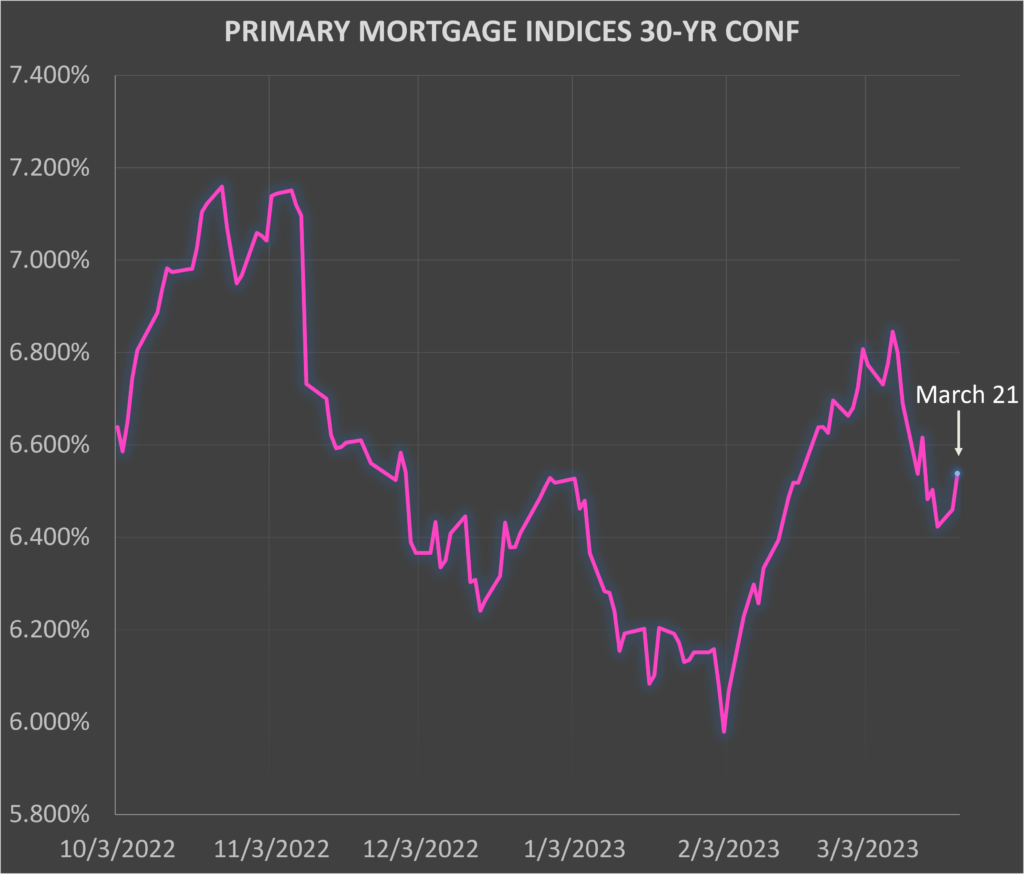

As shown in Figure 1, after climbing above 7 percent in November, for the first time since 2002, mortgage rates dipped close to 6 percent in February before drifting back up to 6.8 percent last week. The average rate for an identical loan was 4.2 percent the same week in 2022.

Other home loans are more closely tethered to the Fed’s move. Home equity lines of credit and adjustable-rate mortgages — which each carry variable interest rates — generally rise within two billing cycles after a change in the Fed’s rates.

How Does If Affect Other Consumers?

Credit card rates are closely linked to the Fed’s actions, so consumers with revolving debt can expect to see those rates rise, usually within one or two billing cycles. The average credit card rate was 20 percent as of March 15, according to Bankrate.com, up from around 16 percent in March last year, when the Fed began its series of rate increases. But Americans, especially seniors, are finally benefiting from higher bank savings yields after years of paltry returns.

How Stock Market Reacted?

Stocks ended the day sharply lower, appearing to take particular issue with the Fed’s refusal to commit or hint at rate cuts later this year. The Dow Jones Industrial Average slid more than 530 points, or 1.6%, to close at 32,030 on Wednesday.

What Does Future Hold?

Along with its ninth hike since March 2022, the rate-setting Federal Open Market Committee noted that future increases are not assured and will depend largely on incoming data. The Fed is anticipating another quarter-point increase to a peak range of 5% to 5.25%, in line with its December estimate and lower than the level markets anticipated before SVB’s meltdown, according to the officials’ median estimate.

While comments Fed Chair Jerome Powell made during a news conference were taken to mean that the central bank may be nearing the end of its rate-hiking cycle, he qualified that the inflation fight isn’t over.“ The Committee will closely monitor incoming information and assess the implications for monetary policy,” the FOMC’s post-meeting statement said. “The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.“ That wording is a departure from previous statements which indicated “ongoing increases” would be appropriate to bring down inflation. Job growth, pay increases and consumer spending also have accelerated after downshifting last year, compounding inflation concerns.

Let’s Connect

Lets connect if you are looking to purchase a home or sell your current home or both. This is a changing rate environment and you need an expert by your side to help guide your decision making.