How much was the rate cut?

The Federal Reserve on Wednesday enacted its first interest rate cut since the early days of the Covid pandemic, slicing half a percentage point off benchmark rates in an effort to head off a slowdown in the labor market.

With both the jobs picture and inflation softening, the central bank’s Federal Open Market Committee (FOMC) chose to lower its key overnight borrowing rate by a half percentage point, or 50 basis points, affirming market expectations that had recently shifted from an outlook for a cut half that size.

Outside of the emergency rate reductions during Covid, the last time the FOMC cut by half a point was in 2008 during the global financial crisis.

The decision lowers the federal funds rate to a range between 4.75%-5%. While the rate sets short-term borrowing costs for banks, it spills over into multiple consumer products such as mortgages, auto loans and credit cards.

What it means for the housing market?

Around this time last year, fixed mortgage rates were hovering around 8%. Fortunately, potential and current homeowners are now seeing major progress in the housing market.

Rates are already hitting into the high to low fives. That’s a big difference for homeowners and for sellers. Figure 1 shows the historical 30-year fixed interest rates until September 18, 2024.

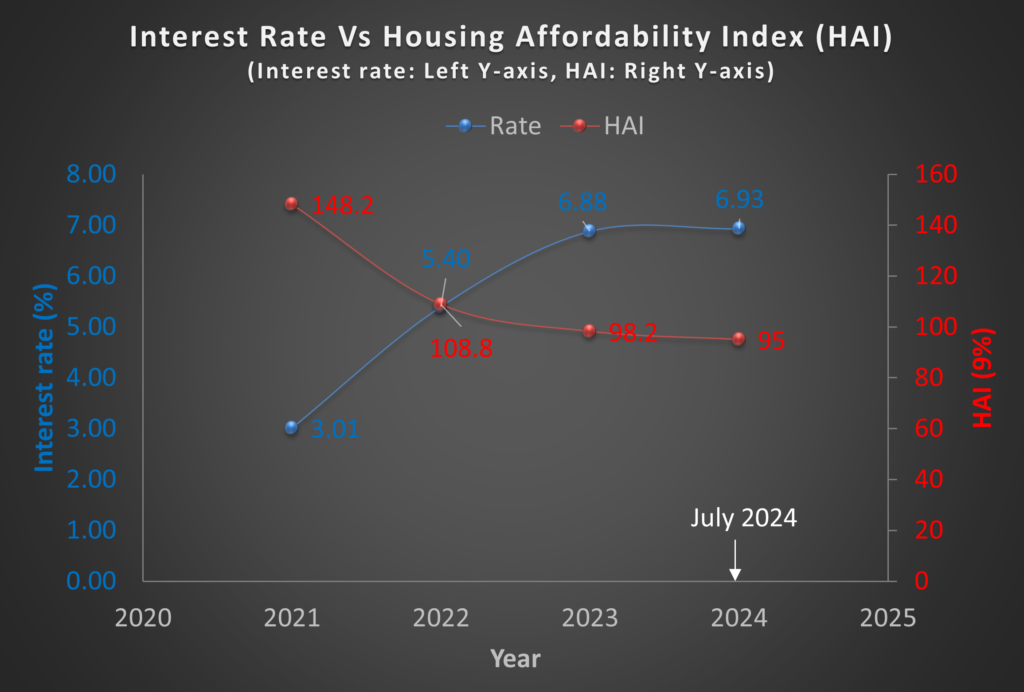

Rate increases which began in 2021, have resulted in tired home buyers as well as sellers. Lower interest rates may be a good news for the market. Both home buyers as well as seller have been waiting for relief in rates. Reduced rate is especially good news for first-time homebuyers who have been priced out of the market. As shown in Figure 2, affordability has been decreasing for past few years.

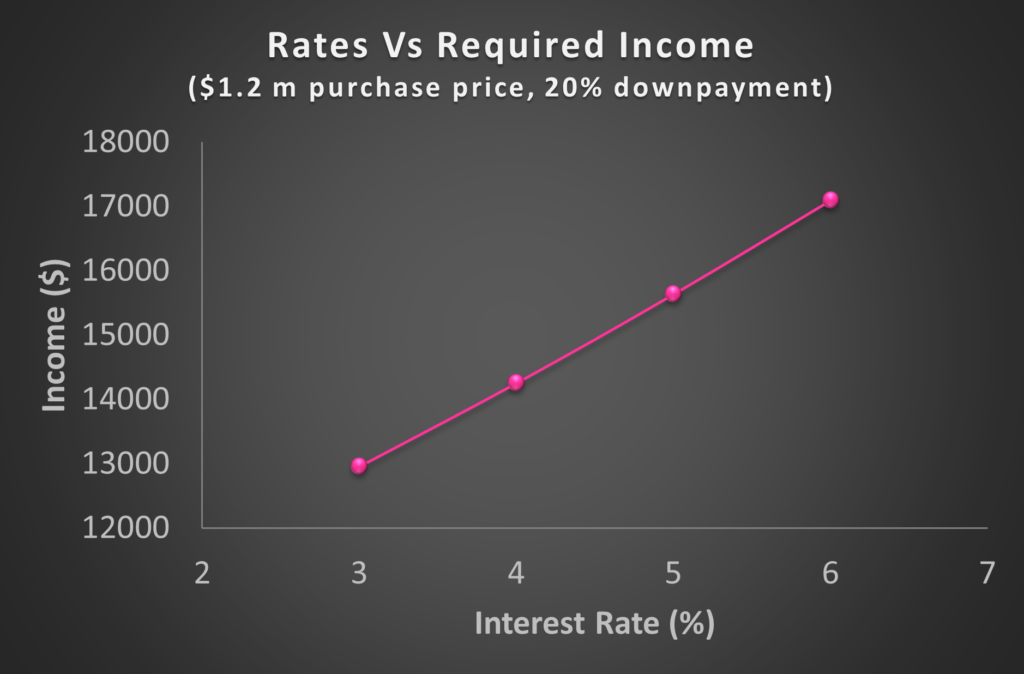

As shown in Figure 3, when rate goes from 3% (2021) to 6% (2023) significantly more (30% more) income is required to purchase a $1.25m home with 20% downpayment.

Incomes across various sectos do not increase that steeply. In fact, According to the latest data from the California Employment Development Department, the state’s GDP growth rate was 3.9% in the previous fiscal year, contributing to an average annual salary increase of 3.5% across various industries.

If the Fed reverses course as aggressively as it raised rates, financing costs would go down. This may motivate buyers as well as sellers. This can creat a flood of inventory of existing homes and taking some heat off prices. Lower interest rates and improved inventory may spur the market. Whether this really happens needs to be seen. The current rates may still not motivate sellers who have locked in long term interest rate belw 3%.

What does the future hold?

In a Wednesday afternoon press conference, Fed Chairman Jerome Powell took a fairly even-keeled stance, noting the economy is in “good shape” and the aggressive cut is meant to “keep it” in a healthy situation with “solid” growth, downward trending inflation and a steady labor market.

Powell declined to make any wide sweeping proclamations about the speed or size of future rate cuts, though he did characterize it as a “cutting cycle,” indicating it’s not a one-off event. Quarterly projections also released Wednesday indicated median Fed staff forecasts call for another 50 basis points worth of cuts this year and a further 100 basis points in 2025, bringing the target range down to 4.25% to 4.5% and 3% to 3.25%, respectively.

Let’s Connect

The current and upcoming interest rate environment will offer opprtunities for home sellers and as well as buyers. We at Saffron Realty are constantly watching the markets and prepared to help you navigate it. So, lets connect if you are looking to purchase a home or sell your current home or both. This is a changing rate environment and you need an expert by your side to help guide your decision making.