The median U.S. home prices reached a record $387,600 in the four weeks ending May 19, marking a 4% year-over-year increase, according to data released Thursday by Redfin.

The pricing surge comes despite a marginal dip in weekly average mortgage rates, which fell from a five-month high of 7.22% to 7.02% at the beginning of May, according to Freddie Mac. Consequently, the median monthly housing payment now stands at $2,854, just $20 short of April’s all-time high.

Simultaneously, persistently high housing costs have driven pending home sales down by 4.2% year over year, the largest decline in three months with the exception of the previous four-week period, which saw a 4.4% drop.

The market continues to grapple with insufficient inventory, Redfin reported. New listings have risen approximately 8% compared to last year, yet overall inventory remains below typical spring levels. Many homeowners, reluctant to exchange their current low mortgage rates for higher ones in pursuit of larger or upgraded homes, are staying put.

Move-up buyers are feeling stuck because they’re ready for their next house, but it just doesn’t make financial sense to sell with current interest rates so high. The homeowners listing right now are often doing so because they have to: They are selling may be due to a family emergency, or because family size is growing and they simply don’t have enough room.

“Buyers should take note that many of today’s sellers are motivated; if a home doesn’t have other offers on the table, offer under asking price and/or ask for concessions because many sellers are willing to negotiate.”

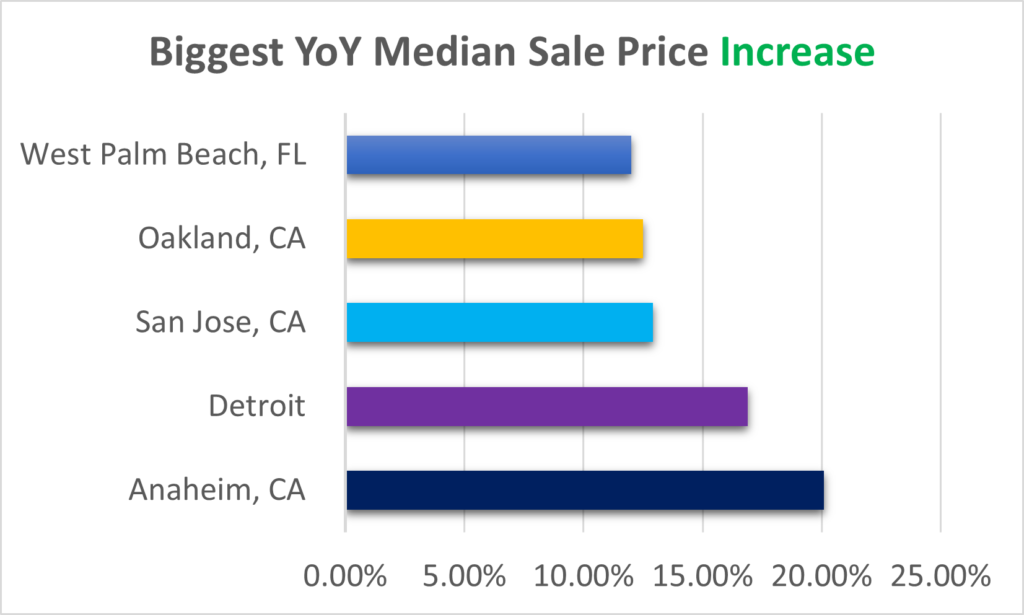

Figure 1 shows the U.S. metro areas with the largest year-over-year increases in median sale prices during the four weeks ending May 19.

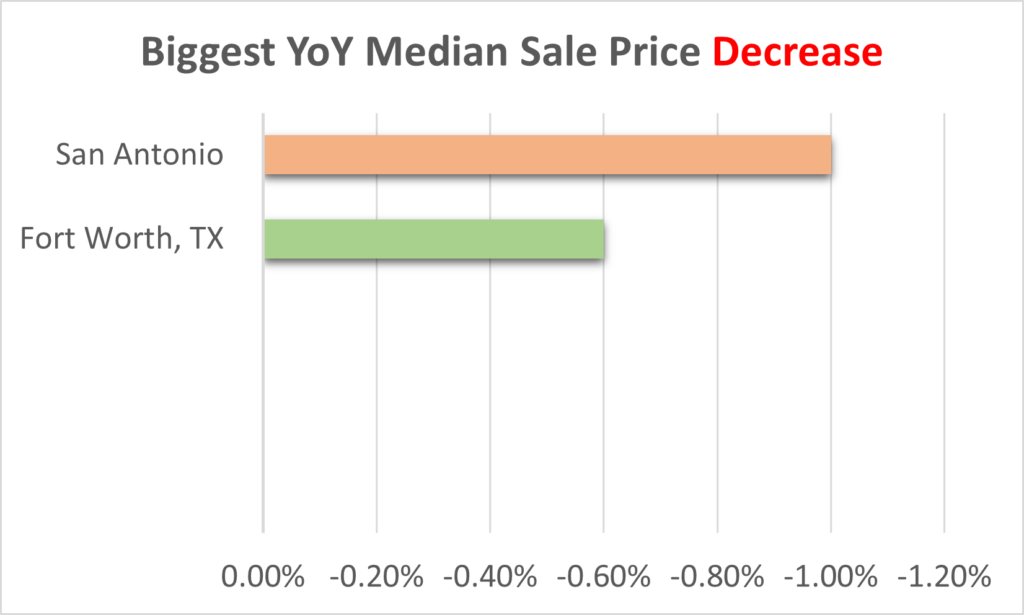

And out of 50 metro areas studied by Redfin, only two showed drop in median sale price as shown in Figure 2. The highest drop was 1% for San Antonio.

Buyers in the current market need to consider this carefully. Home prices are not breaking substantially even though interest rates have been high for quite some time. The inventories are still at historically low values. One reason for this could be that there is a strong supply of buyers which keeps prices from falling significantly.

If you are a seller you are at a good spot. If the interest rates were to decreases then the markets can again become ultra-competitive. If this happens then the homes prices are likely to go further high. Only one scenario can go against you. That is if interest rates were to keep going up. Because that may results in intense pressure on affordability and prices will have to break.

This is an unforeseen market environment and no matter what side of the market you are in, you will find it difficult to navigate. And you need an expert by your side to help guide your decision making. Lets connect if you are looking to purchase a home or sell your current home or both.

(Image credit www.freepik.com)